Abstract Core note: The dollar's rise has hit US dollar-denominated base metals, and China's news of eliminating backward production capacity, especially manufacturing capacity, is also putting pressure on base metal prices. This week, the market will turn its attention to the United States, which includes US economic growth data, key monthly employment...

Core tips: The dollar’s ​​rise has hit dollar-denominated base metals, and news that China’s elimination of backward production capacity, especially manufacturing capacity, is also putting pressure on base metal prices. This week, the market will turn its attention to the United States, which includes US economic growth data, key monthly employment data, and US Federal Open Market Committee interest rate decisions.

[Latest market]

â— LME Electronics - Copper 6855 fell 155, aluminum 1798.5 fell 25.5, zinc 1849 fell 28, lead 2053.8 fell 21, nickel 13843 fell 314, tin 19460 fell 2, aluminum alloy 1780 fell 15.

â— International spot gold 1330.9 fell 2.81, silver 19.93 fell 0.08, platinum 1428 fell 1.5, palladium 724.5 fell 1.25.

â— LME copper stock 621175 minus 1775 aluminum stock 5843175 increase 19150 zinc stock 1051025 minus 4275 lead stock 198250 minus 250 nickel stock 199578 minus 432 tin stock 14545 increase 155.

â— Shanghai Futures Trading Weekly Inventory: copper stock 161564 minus 5865 aluminum stock 365742 minus 11916 zinc stock 269310 minus 3116 lead stock 111903 minus 81.

[LME Interpretation and Today's Forecast]

â— Lun copper early comment: Last Friday night, Lun copper continued the pattern of falling during the Asian session, falling to the lower limit of the shock range, the rebound pattern ended, and the copper returned to the weak. China's economic growth concerns remain the core factor in the pressure on copper prices.

â— Lun aluminum early comment: last Friday, the copper price fell, driving Lun aluminum also fell more than 1%; at present, the dollar has basically returned to the position, which makes the metal trend further pressure; but whether it has returned to the current trend Need to observe.

â— Long lead early evaluation: Due to the weak pressure of surrounding metals, the lead has fallen slightly, and the overall price is still in the range of 2000-2100 US dollars, but the short-term pressure from the surrounding, or weak, but the domestic lead price is still stable.

â— Long-term evaluation of zinc: China's metal demand outlook is bearish, and the weekly zinc is broken, but the cost support is still effective. It is expected that the recent sharp decline in zinc may be small, and it may still be bought at around $1830.

â— Lunxi early comment: Lunxi continued to sideways on Friday. The intraday trend showed a resilience, but the range and center of gravity shifted slightly. Changes in positions and positions showed a large amount of funds withdrew, and the intraday range looked at 1.92-1.95 million.

â— Lun Nickel early comment: Lun copper led the decline of basic metals. Last Friday, Lun Nickel fell below 14,000. The short-term rebound ended and the nickel price returned to the weak and shocking process. The ex-factory price of Jinchuan is now down or down.

[Industry Interpretation]

â— China's Ministry of Industry and Information Technology requested to close 654,400 tons of copper production capacity by the end of September

The Ministry of Industry and Information Technology requested that the copper smelting capacity of over 650,000 tons be shut down before the end of September, including the recycled copper industry, and the oversupply problem in the copper market will gradually become more prominent in the second half of the year. The elimination of copper production capacity is not only beneficial to the environment but also to the late fundamental market. Provide a small support, but the mitigation effect is more limited.

â— China's Ministry of Industry and Information Technology announced on Thursday the list of the first batch of enterprises in the industrial sector to eliminate backward production capacity, involving copper smelting, alumina and zinc smelting and other industries, indicating that China's actions to resolve overcapacity problems are being further implemented.

Interpretation: In the face of overcapacity problems, the Chinese government has eliminated the backward production capacity of zinc smelting last year by 351,200 tons. This year, it again exerted its strength. The first batch of zinc (including regenerative zinc) was 146,200 tons. It is expected that the domestic zinc surplus will gradually improve. There is not much room for the price to fall later.

[Financial Express]

Dow Jones index 15558.8 rose 3.2, Nasdaq 3361.17 rose 7.98, Hang Seng index 21968.95 rose 67.99, CRB index 509.48 fell 5, US dollar index 81.57 fell 0.08, EUR/USD 1.3286 rose 0.0008, USD/JPY 97.91 fell 0.33, US crude oil 104.54 Fell 0.16.

[Auditor Reads Finance]

â— UBS: Three reasons do not have to worry about the Fed slowing QE

Interpretation: The Fed has made it clear that unless the economy is better and does not require further QE support, the Fed will not withdraw QE. Second, the utility of QE-type monetary policy should have its lag. Even if the Fed gradually stops expanding its balance sheet, the US banking industry will still be full of liquidity and excess reserves that have been added to the banking system. Finally, there is a growing likelihood that rising mortgage rates will not significantly reduce home mortgage demand.

â— IMF urges US effective communication exit strategy to avoid excessive interest rate fluctuations

Interpretation: The annual review of the US economy said that the withdrawal of the Fed from the QE may trigger a market reaction, resulting in “excessive†interest rate volatility, which will have a negative impact on the world. Although the Fed has a range of tools to manage the normalization of the currency, the central bank still faces “significant challenges†in exiting the stimulus. While easing policy continues to provide the necessary support for recovery, it should carefully measure its impact on financial stability, as ultra-low interest rates remain too long and have unintended consequences for financial stability, which will make macroeconomic policies in some emerging markets more complicated.

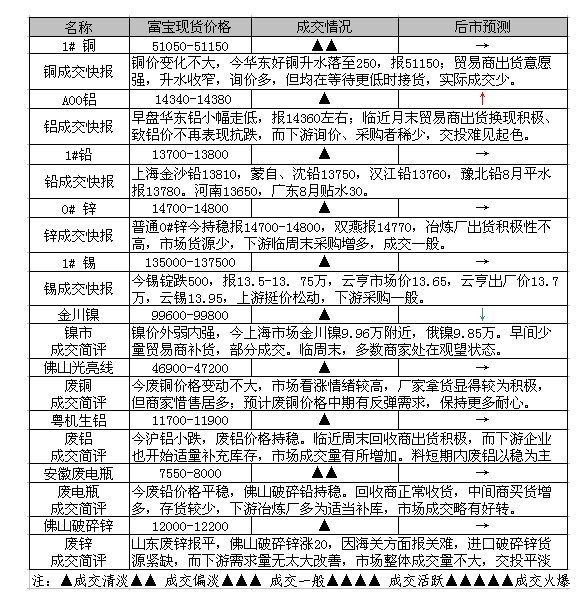

[Spot Review]

SC61 High End Stereo Microscope

Sc61 High End Stereo Microscope ,Stereo Light Microscope,Stereo Binocular Microscope,Dissecting Microscopes

Ningbo Beilun Kalinu Optoelectronic Technology Co.,Ltd , https://www.yxmicroscope.com